About Course

Wealth Building & Financial Freedom

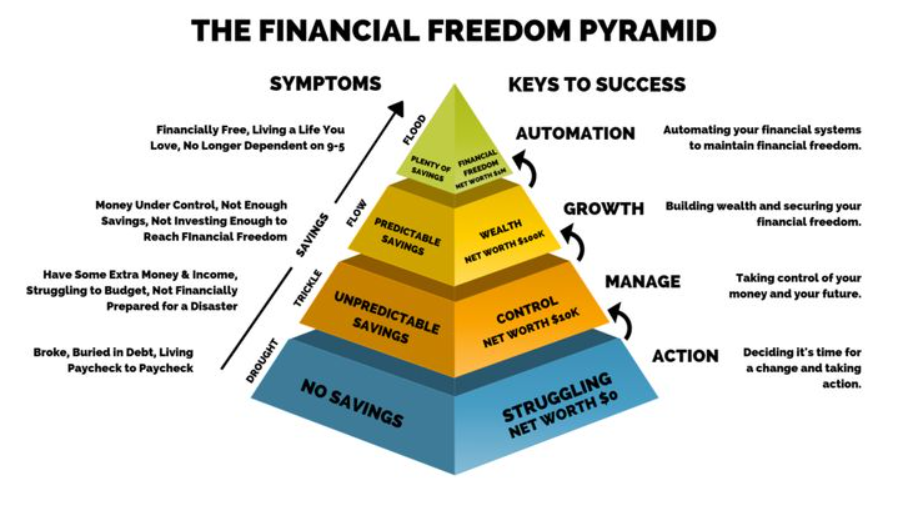

Wealth building and financial freedom are two powerful concepts that go hand in hand, forming the foundation for a secure and fulfilling life. At their core, they represent not just the accumulation of money, but the ability to live life on your own terms—without being chained to financial stress or limited by paycheck-to-paycheck living.

Wealth Building: The Journey of Growth

Wealth building is the strategic process of growing your financial resources over time through a mix of smart saving, investing, and income generation. It’s not just about making money—it’s about making money work for you. This involves:

-

Budgeting and Saving: The first step is living below your means. That means creating a realistic budget, cutting unnecessary expenses, and consistently setting aside a portion of your income.

-

Investing: From stocks and real estate to mutual funds and business ventures, investing allows your money to grow exponentially over time. The key is to start early and invest regularly.

-

Multiple Income Streams: Relying on one income source is risky. Building wealth often involves diversifying your income—whether through a side hustle, rental property, dividends, or a small business.

-

Financial Literacy: Understanding how money works—interest rates, debt management, market cycles—is crucial. Knowledge empowers better decisions and prevents costly mistakes.

Financial Freedom: The Destination

Financial freedom means having enough wealth and passive income to cover your living expenses without actively working for money. It’s the point where work becomes a choice, not a necessity. This level of independence allows you to:

-

Pursue Passions: You can focus on what you want to do instead of what you have to do for money.

-

Retire Early: With smart planning, early retirement becomes a realistic goal, freeing up decades for meaningful pursuits.

-

Live Stress-Free: No more worrying about bills, debt, or emergencies. Financial freedom brings peace of mind and control over your time.

-

Create Legacy: With your finances in order, you can focus on giving back, supporting causes you care about, and leaving a legacy for the next generation.

The Mindset Matters

Wealth building and financial freedom are not just about numbers—they’re about mindset. Discipline, patience, consistency, and a long-term perspective are the traits that separate those who struggle from those who succeed financially.

It’s also important to note that this journey is personal. Your version of financial freedom may not look like someone else’s, and that’s okay. The goal is to create a life where money supports your values and dreams—not one where you’re always chasing more for the sake of more.